Value Link Advisors – Exit Planning Services

Covering Your Business, Personal, and Financial Goals

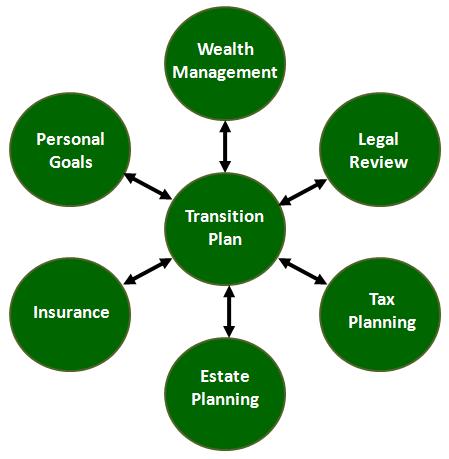

We work with expert partners to develop a exit plan that covers:

Financial Planning / Wealth Management

Tax Planning

Insurance

Legal Review

Personal Goals

Estate Planning

Financial Planning & Wealth Management

Converting business value into personal wealth.

The Four Places Your Money Can Go

- Your personal lifestyle

- Your family

- Charity

- Government

Retirement Funding Options

- Business provided retirement income as a non-active owner or debt holder.

- Net proceeds from the sale of the business provides income for retirement.

Some information to consider

- 90% of a small business owners’ wealth is in the business.

- Unless you know how much money you need for retirement you are rolling the dice with your personal and family security

3 Questions must be answered…

- How much do I need?

- What rate of return do I need from my investments to secure future?

- How will I handle market volatility?

Variables for Planning

- Age at retirement

- Spending in retirement

- Assets at retirement

- Asset allocation, rebalancing and Monte Carlo analysis

Proper Wealth Management Provides

- Security and peace of mind

- Guidance from experts

- Tax efficiency; effective us of Estate Planning and Trusts

- Asset protection; effective use of Estate Planning and Trusts

- Ability to transfer wealth generation to generation efficiently

- Risk minimization via insurance products

Tax Planning

As we’ve stated previously the government is one option for allocating proceeds from income or sale proceeds of a business. Creating the most value from a transaction is not always getting the highest sale price. Issues such as a stock sale vs. an asset sale, cash vs. deferred payment, transaction structure, and use of estate planning strategies implemented before the transaction all impact the effect of taxes on the business owner.

What effects the amount of cash available from a transaction?

- Transaction costs

- Taxes

- Retained debt

- Timing of payments

- Depreciation recapture

Seller’s Goals

- Reduce or eliminate double taxation

- Use of capital gains vs. ordinary income

- Defer, minimize or eliminate taxes

Capital gains and the inheritance tax is sometimes referred to as a “voluntary tax” because business owners control whether or not to pay this tax by careful planning. The lack of a well designed tax strategy can cost a business owner 50% of the proceeds from a sale. The ROI of getting expert tax advice is greater than almost any other business decision you will make.

Insurance

Small business owners often overlook the many types of insurance that can protect themselves, their family and the business from economic disaster.

Insurance Needs

Life insurance provides liquid tax-free benefits to survivors to cover health/ death expenses, debt payoff, estate taxes, and future family need.

“Split Dollar” is using life insurance to allocate cost and benefits for multiple uses

- Fringe benefit for key person protection

- Retention tool

- Cost effective for personal life insurance

- Income protection

- Fund buy / sell agreement

- Non-qualified retirement fund

- Used in conjunction with estate and trust planning

Personal Disability Protection

Business Interruption / Disaster Insurance

Fund Tax Obligations

Legal Review

An experienced business attorney is an important member of your Transition Team. An attorney should be involved early in the process, well before any important decisions need to be made. Many times when brought in late and attempting to fulfill their role as a “protector” an attorney can become a barrier or even a “deal killer” rather than a resource.

Areas than an Attorney is needed are:

- Estate Planning

- Personal Liability

- Asset Protection

- Contracts / Agreements

- Buy / Sell Agreement if partnership

- Pre-transaction due diligence. This function is often overlooked by many business owners, but proper due diligence is critical to identifying and correcting potential problems long before a lender or buyer begin their due diligence review.

Personal Goals

Setting goals for your business is a given: they’re powerful contributors to successful growth in several ways. First, the process of setting goals forces you to think through what you want from the business. The goal formulation process helps suggest directions for accomplishing those goals, which greatly improve your chances of achieving those goals.

The same is true when it comes to thinking about exiting your business.

Goals give you and your exit planning team a framework within which to work. This framework tends to focus efforts by helping to rule out actions that will not contribute to achieving your goals.

An exit planning strategy should begin by determining your goal and objectives such as:

- What is the income you and your family will need after you leave the business?

- Who you wish to transfer the business to – whether it be children, company management or a third party sale?

- I will exit my business by the time I’m 60 years old.

A very important part of creating a clear statement of goals is defining a timetable. Any good goal must have a timetable that influences everyone’s actions profoundly. For instance, if your goal is to be fully exited from your business by age 60, you must then work backward from that date.

It is not enough to simply have goals. They need to be appropriate, realistic, and achievable. Make sure your goals are SMART:

- Specific

You stand a better chance of achieving a goal if it is specific or quantified. “Maximizing my company’s value when I exit” is not a specific goal; “netting $5,000,000 or more after taxes when I exit” is. - Measurable

You probably want your company to provide you with financial security. Translate that goal into a measurable goal. That means determining how much money you need to make each year (or some other criteria) so you can define and measure whether the company is meeting your goal. - Achievable

Goals must be positive and uplifting. “Being able to retire” is not exactly an inspirational goal. “Having $10 million in the bank so I never need to worry about money again” rephrases the same goal in a more specific, positive manner. - Realistic

Goals that are too aggressive are never met. It is better to begin with smaller, achievable steps, such as increasing the company’s earnings by 20 percent. After the first goal is met, you can reach for larger ones. - Time Oriented

Short-term goals are attainable in a period of weeks or months. Long-term goals are achieved in one, five, or even 10 years. Every plan needs a good balance of short-term and long-term goals.

Define your goals in areas such as travel, hours of work, investment of personal assets, and geographic location. How many hours are you willing to work? How much risk do you feel comfortable with?

Some goals, even though sincere, may be inconsistent with other equally sincere goals. Very often a business owner is too close to the issues involved to see that his or her goals may be inconsistent. Understand which goals are consistent and which are not. If goals are not consistent, prioritize them.

The most important rule of goal setting is honesty. Without exception, you need to be honest about your strengths and weaknesses, likes and dislikes, and ultimate ambitions. This clarity enables you to confront dilemmas with greater confidence and a greater chance of success.

Estate Planning

Estate planning is an important part of your strategy to exit the business. If not done properly you may place your family and business in jeopardy.

Estate planning is a process. It involves people—your family, other individuals and, in many cases, charitable organizations of your choice. It also involves your assets (your property) and the various forms of ownership and title that those assets may take. Most importantly, it addresses your future needs if you become unable to care for yourself.

Through estate planning, you can determine:

- How and by whom your assets will be managed for your benefit during your lifetime if you ever become unable to manage them yourself.

- When and under what circumstances it makes sense to distribute your assets during your lifetime.

- How and to whom your assets will be distributed after your death.

- How and by whom your personal care will be managed and how health care decisions will be made during your lifetime if you become unable to care for yourself.

Many people mistakenly think that estate planning only involves the writing of a will. A will is part of the planning process, but you will need other documents as well to fully address your estate planning needs. Estate planning, however, can involve financial, tax, medical and business planning.

There are many issues to consider in creating an estate plan. First, ask yourself the following questions:

- What are my assets and what is their approximate value?

- Whom do I want to receive those assets—and when?

- Who should manage those assets if I cannot—either during my lifetime or after my death?

- Who should be responsible for taking care of my minor children if I become unable to care for them myself?

- Who should make decisions on my behalf concerning my care and welfare if I become unable to care for myself?

Once you have some answers to these questions, you are ready to seek the advice and services of a qualified lawyer. A lawyer can help you create an estate plan, and advise you on such issues as taxes, title to assets and the management of your estate.

How do I reduce my estate taxes?

Generally this is done through gifting assets such as highly appreciated stock into a trust for the benefit of a spouse and children or for the benefit of charitable organizations, or gifting away interests in closely held business entities. Once the assets or business interests are gifted away from the owner and into the trust, they can no longer be included in the owner’s estate for tax purposes.

I want to create a legacy…

Different types of trusts can be established not only to minimize or eliminate estate taxes, but to also create an ongoing legacy for your future generations. Many states allow trusts to continue for hundreds of years or even in perpetuity, thereby allowing their residents to establish dynasty trusts for their current and future family members. Others choose to create a legacy in their community by setting up charitable trusts or foundations that will provide a self-perpetuating endowment for years to come.

How can I protect my assets?

For those who have accumulated even minimal wealth, the fear of losing it all to a lawsuit can become a great concern. Many advanced trusts, such as Legacy Trusts, can not only help to minimize estate taxes, but offer the added protection against judgments and divorce decrees. In fact, self-settled domestic and offshore trusts are specifically designed to keep assets held in these trusts away from creditors.

Talk with a Value Link Advisor about these and other strategic estate plans that protect your estate and your family.